Budgeting with Google Docs

March 06, 2011

Budgeting is Hard

While in college I used Mint to manage my finances and budget. Budgeting for myself was hard; budgeting for two people is (exponentially?) harder.

After marrying, my wife and I continued to use Mint. After several months we she decided to try Dave Ramsey’s “cash only envelope system”. After the first paycheck of using cash we were amazed at how well we managed our money.

Cash is Physical

When you’re handing over several $20 bills rather than swiping a card, well, your handing over several $20 bills. It makes each transaction a little harder on you. It’s a mental transaction, as well as a physical one. It makes you ask, “do I really need this?”, or, even better, “do I have enough cash for this?”

I think using cash is similar to the way that writing something by hand (rather than merely reading or typing) helps you to understand and remember something. Using cash takes a little longer and it is more of a physical exchange - you hand over cash and you get an item. When using a debit card, you keep your card (hopefully), and perhaps imagine that number in your bank account shrinking.

Cash Puts You in Control

Using cash also means you have to budget your money ahead of time. When we were using Mint, we had budgets created and it was nice that Mint automatically categorizes transactions for you. However throughout the period between paychecks we would always go over in one area and under in one area. Using the cash method, we budget for each category and each category gets an envelope for cash. When the envelope is empty, that means we’ll have to wait until next paycheck to buy something in that category. Mint does provide “real time” budget amounts, but sometimes debits don’t post on the same day or don’t show the correct amount until posted. And it’s just not as obvious as an empty envelope.

Exceptions

It’s worth noting that we don’t actually use cash for everything. We use debit/credit where we find it to be an inconvenience to use cash, or where we don’t typically spend beyond our means. For example, I pay all of our bills online with a credit card (easy rewards points) and then immediately pay it off with a transfer from our checking account. We pay for gas with debit/credit for the convenience. All of these expenses tend to be fixed every month or at least somewhat predictable.

Mint’s Replacement

I use Google’s online applications for several things. I’ve already written how I use Google Calendar for bill reminders. I use Gmail (who doesn’t?) and I use Google Reader to keep up with my favorite blogs. I use Google Tasks for things like grocery lists and books to read. Google Chrome is essentially my OS and I always have Gmail, Reader, and Calendar as pinned tabs.

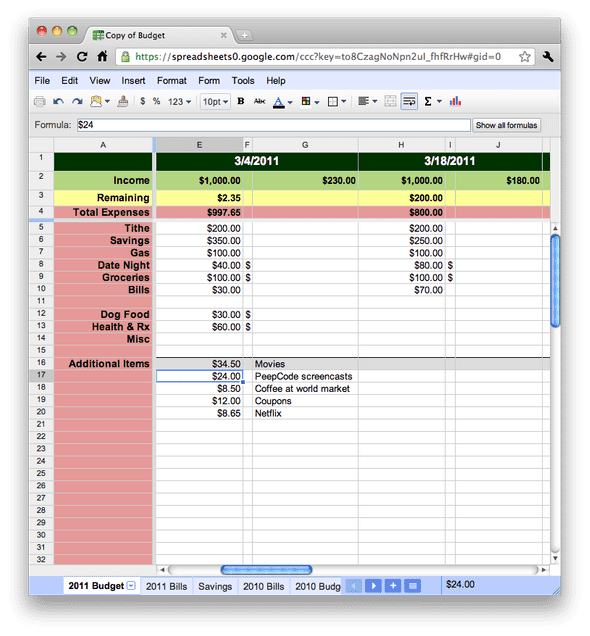

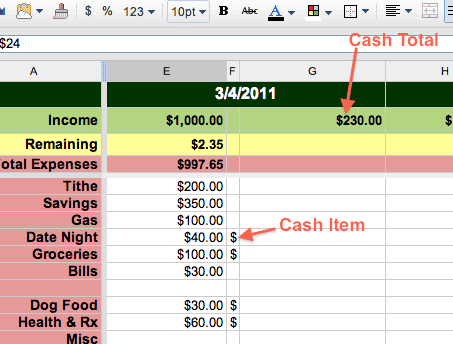

I was a fan of Mint, and I used it a couple of months after switching to cash, but it just seemed like the wrong tool for the job. I had used Google Docs Spreadsheets for us to keep up with other financial information (medical school loans are complicated.) So I put together a spreadsheet to manage our budget based on a bi-weekly pay period. Here’s the result after months of manipulation and improvement (note: amounts may be edited for obvious reasons).

With this spreadsheet, we can easily budget months in advance just by scrolling to the right and budgeting for the desired pay period.

Along the very top is the (bi-weekly) date of the paycheck. Under each date are three columns. The first column are money values for various things, some are static (e.g. Income) and some are dynamically calculated (e.g. Total Expenses, Remaining).

Calculations

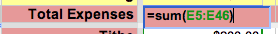

Most of the spreadsheet uses basic calculations. The Total Expenses row is pretty obvious, just sum everything below it.

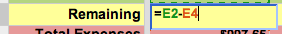

Similarly, the Remaining row is just the difference between the Income and the Total Expenses.

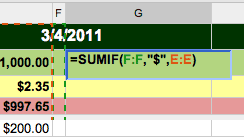

Something I got tired of quickly was determining what expenses we needed to withdraw cash for. Typically we’ll withdraw however much cash we need (based on the budget) on payday. I began developing an app in Ruby on Rails (I don’t know that I really needed an app or was just wanting to learn something new), but I finally realized I was just trying to build an application that a spreadsheet should be able to solve. All I needed was something that could calculate a sum based on a conditional value (the condition here was whether or not the expense needed a cash withdrawal).

I quickly found out that there’s a SUMIF() function baked into Google Docs:

So that’s when I created an additional column for each pay period to denote whether or not we needed cash for the expense. I use an appropriate cash symbol ($) to distinguish those expenses that are cash items. Using the SUMIF() function I can get the total amount I need to withdraw when I go to the bank on payday. One more thing automated!

Handling Various Bill Cycles

My wife’s in medical school and so we have a good dose of loans every year. What we do is place these loans into a checking account and then equally divide the total across a 12 month period to cover costs. The amount we use each month typically covers almost all of our recurring bills. You may have noticed we don’t have any specific bills (e.g. electric, AT&T, etc) in the budget above. That’s because we don’t typically use my paycheck to pay bills; we usually use loan money to cover those. However, sometimes the loan money is not enough to cover all the costs of the bills, so we do have a generic “Bills” expense that we use to cover these overages.

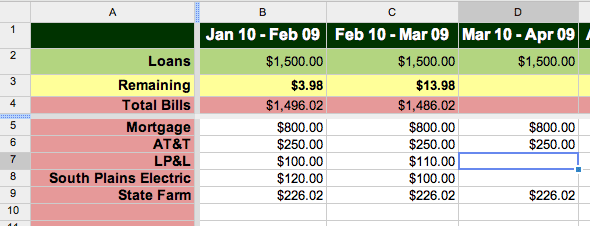

I created a separate spreadsheet for monthly bills. They group well together with the loan money because the bills occur once a month, and we use an allotment of our loan money once a month. I thought about trying to integrate everything into one budget spreadsheet, but because our incomes vary by date and occurrence (i.e. I’m paid every two weeks and use our loan money on the 10th of every month) I felt it was best to keep them separate for the sake of simplicity. Here’s our bills spreadsheet:

This spreadsheet is very much similar to our budget spreadsheet, only much simpler. Because all are non-cash expenses (we pay them all with a credit card to earn rewards points, and then pay off the amount immediately from our checking), we have no need to distinguish between cash and non-cash items. Any time the Remaining amount becomes negative, that means our budget (from my paycheck) needs to compensate the difference. This spreadsheet has an added bonus of us being able to keep track of any abnormal billing changes.

Manage your money - don’t let it manage you

Some may argue that Mint is better because it will automatically categorize your money and provide amazing charting tools to analyze spending trends. You can save a lot of time by using Mint. I can’t argue that Mint doesn’t have some neat tools and charting, but I don’t think that it helps with budgeting. The fact that we have to manually budget and keep track of expenses with a spreadsheet helps us better understand how we’re spending our money.

We tell our money what it can do, not the other way around.